Amarkets

Regulated By : TFC

Headquarters : ![]() Cook Islands

Cook Islands

Min Deposit : 100 USD

US Clients :

Leverage : 1:3000

Established Year : 2007

AMarkets is a Forex and CFD broker which provides professional, yet easy-to-use trading tools both for experienced and novice traders.

AMarkets is no stranger to the market of brokerage service, the Company was registered in 2007 under the trademark Adrenalin Forex.

The broker began to conquer the market of financial services and attract customers. In 2010, the company embarked on a re-branding mission, so the AForex brand was established. High-quality and powerful advertising support and unique promotional policy quickly did their job and the broker with the investors began to enjoy the first results, continuing to move towards success. New interesting products appeared under the AForex brand, for example, the service of copy trading. All this eventually shaped into a stable and well functioning copy-trading service, which is popular among both traders and investors.

In 2015, AForex brokerage services went beyond the Forex currency market – clients were offered stock and commodity markets trading on CFDs (contracts for difference). In this regard, it was decided to create a new brand that clearly reflected trading opportunities available to all clients. Renamed to AMarkets, the Company and its team of professionals continued to work in the name of the financial well-being of its clients and partners, providing an opportunity to work with stocks CFD, indices, commodities, metals and even cryptocurrency!

The broker provides a remarkable level of client service and is known for its stable and ultra-fast platform, spreads as low as 0.2 pips and instant order execution through NDD (No Dealing Desk) technology. The official website amarkets.com contains a large database of various educational and training materials, unique indicators, video trading, special promotions and bonus offers.

Key features

- TRANSPARENT WORKING CONDITIONS

The primary goal of AMarkets is to provide quality brokerage services and increase the level of success of its customers. Being an STP (Straight Through Processing) broker, AMarkets uses the advanced NDD (No Dealing Desk) quoting technology to transfer trading orders directly to liquidity providers in the interbank market – Deutsche Bank; Credit Suisse; Barclays; UBS; Morgan Stanley; BNP Paribas;

- RELIABILITY

For over ten years of its activity, AMarkets has been proving itself as a broker with an impeccable financial reputation and a high level of trust both in a professional trading environment and among numerous partners around the world.

- DEVELOPMENT OF TRADERS’ TRADING SKILLS

In addition to premium brokerage services, AMarkets offers the maximum opportunities for developing trading and analytical skills of traders. Personal managers of the company act as expert guides, providing all the necessary information: interpretation of fundamental news, trend direction, market entry points and technical analysis signals.

- PROFESSIONAL ANALYTICS

AMarkets offers its clients free access to the world’s leading analytical services, including “Autochartist” automatic pattern recognition system and online forecasts of the movement of financial assets based on technical analysis from certified advisors.

- Available Trading Instruments

- 18 Commodities

- 27 Cryptocurrencies

- 427 Stocks

- 16 Indices

- 44 FX

- 19 ETF

- Commissions & Spreads

Spreads on ECN accounts are very tight, starting from 0.2 pips

- Platforms & Tools

AMarkets offers MetaTrader4 and MetaTrader5, two most reliable and renown platforms for Forex trading with a great variety of unique indicators, pre-installed in the terminal.

- Mobile Trading

MetaTrader4 and MetaTrader5 are also available as mobile versions to all AMarkets’ clients. Another important thing worth noting is that amarkets.com site is perfectly optimized for smaller screens of mobile devices, so you are free to perform any types of operations with your account even on the go.

- Unique Analytical Indicators

Three professional market analysis indicators, developed by AMarkets experts – Cayman, COT and the aggregate position. All of the indicators are used by market specialists and are based on statistical data. Besides, access to these signature indicators is free for all clients of the company.

Cayman Market Sentiment Indicator

This indicator is based on the principle of “trading against the crowd” – it assesses the current mood of traders and shows the percentage of traders who buy and sell the currency. In other words, you will always see whether bulls or bears dominate the market. The indicator allows you to predict the potential points of the market reversal and determine possible extremes on the charts.

COT-indicator (Commitment of Traders)

Shows the expectations of serious market participants, such as hedge funds and market makers. The information is updated weekly based on the commitment of traders report published by the Commodity Futures Trading Commission. Monitoring the changes in the total volume of open positions (buy and sell) of a given instrument and determining the dominating market sentiment (bullish or bearish) can be a good method to forecast market trends and their potential breakout points.

Aggregate Position indicator

The aggregate position indicator is designed to analyze all open positions and pending orders held by AMarkets clients for major currency pairs. It allows reacting to price changes caused by unrealized profit and loss in a timely manner.

All indicators are user-friendly and can be useful for traders of any level. Besides, each indicator comes with a comprehensive video tutorial that will help you figure things out in the blink of an eye.

Amarkets Overview

Company Information

| Broker Details | Info |

|---|---|

RegulatorsWhat Is Regulation?Forex regulation is therefore all about consumer protection. Regulated Forex brokers are less likely to cheat their clients and where such infractions happen, regulators are empowered by the laws of their respective jurisdictions to apply appropriate sanctions. | TFC |

| Country | |

Base CurrenciesWhat is Base Currency?In the forex market, currency unit prices are quoted as currency pairs. The base currency – also called the transaction currency - is the first currency appearing in a currency pair quotation, followed by the second part of the quotation, called the quote currency or the counter currency. For accounting purposes, a firm may use the base currency as the domestic currency or accounting currency to represent all profits and losses. | USD |

Type Of BrokersBroker TypesThere are two types of brokers: regular brokers who deal directly with their clients and broker-resellers who act as intermediaries between the client and a larger broker. Regular brokers generally are held in higher regard than broker-resellers. | ECN, STP |

Trading PlatformWhat is Trading Platform?A currency trading platform is a software interface provided by currency brokers to their customers to give them access as traders in the Forex markets. This may be an online, web-based portal, mobile app, a standalone downloadable program, or any combination of the three. | Desktop, Mobile, MT4, MT5 |

| Established Year | 2007 |

| Website Language | English |

| US Clients |

Payment Option

| Method | Getway |

|---|---|

| Acc Funding Methods | |

| Acc Withdrawal Methods |

Transaction Fees

| Getway | Fees |

|---|---|

| Skrill | 2.99% + $0.30 per transaction |

| Wire transfer | 1% - 4% of the transaction amount |

| Visa Card | 1.9% - 2.9% of the transaction amount |

| Master Card | 1.9% - 2.9% of the transaction amount |

Trading Account Options

| Type | Info |

|---|---|

Maximum LeverageForex LeverageLeverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance alone. ... Forex traders often use leverage to profit from relatively small price changes in currency pairs. Leverage, however, can amplify both profits as well as losses. | 1:3000 |

Mini AccountWhat Is Mini Account?A forex mini account is a foreign exchange (FX) account which allows beginner traders to enter the currency market using smaller size (mini lot) positions and trading quantities, thus lowering the funds at risk and limiting potential losses. | |

| VIP Accounts | |

Segregated AccountsWhat Is Segregated Account?Segregated account is an important term in the context of Forex trading in which a broker holds their client funds in segregated (separate) accounts that are different from the broker's core banking account. Segregated accounts are used to differentiate between the broker's working capital and its client investments. | |

| Free Demo Accounts | |

Managed AccountsWhat Is Managed Accounts?A managed forex account is where a professional trader/money manager manages the trading on the clients' behalf. The account is made up of a personalized portfolio owned by a single investor. The portfolio and account is handled accordingly to the investors needs. | |

| Pro Account | |

| Minimum Deposit | 100 USD |

Islamic AccountWhat Is Islamic Account?An Islamic Forex account is a halal trading account that is offered to clients who respect the Quran and wish to invest in the Islamic stock market following the principles of Islamic finance. ... As Sharia law prohibits the accumulation of interest, traders with Islamic accounts do not pay or receive interest rates. |

Contact Information & Support

| Type | Info |

|---|---|

| Telephone No | +442038086968 |

| support@amarkets.org | |

| 24 Hours Support | |

| Support During Weekends | |

| Address | N/A |

| Website | https://www.amarkets.com/ |

Amarkets Trading Features

Suitable For

| Trader Level | Yes/No |

|---|---|

| Publicly Traded | |

| Beginners | |

| Day Trading | |

| Weekly Trading | |

| Professionals | |

| Swing Trading |

Spreads And Commission

| Trader Level | Yes/No |

|---|---|

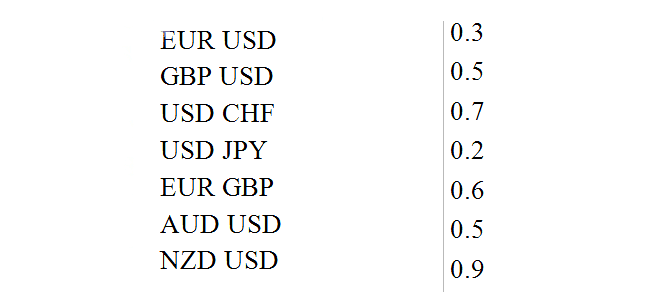

Minimum SpreadsWhat Is Spreads?The forex spread is the difference between a forex broker's sell rate and buy rate when exchanging or trading currencies. Spreads can be narrower or wider, depending on the currency involved, the time of day a trade is initiated, and economic conditions. | 0.1 |

| Commission | |

| Fixed Spreads |

Amarkets Release 6 Bonuses

Trading Services

| Service | Info |

|---|---|

HedgingWhat Is Hedging?Hedging with forex is a strategy used to protect one's position in a currency pair from an adverse move. It is typically a form of short-term protection when a trader is concerned about news or an event triggering volatility in currency markets. There are two related strategies when talking about hedging forex pairs in this way. One is to place a hedge by taking the opposite position in the same currency pair, and the second approach is to buy forex options. | |

| News Trading | |

ScalpingWhat Is Scalping?Scalping in the forex market involves trading currencies based on a set of real-time analysis. The purpose of scalping is to make a profit by buying or selling currencies and holding the position for a very short time and closing it for a small profit. | |

| Automated Trading | |

IndicesWhat Is Indices?The indices track the underlying prices of the currency pairs within that index. If the individual forex prices in that index increase, then the value of the index will go up. Conversely, if the individual FX prices decrease, then the value of that index will fall. | |

CommoditiesWhat Is Commodities?The commodity pairs, or commodity currencies, are those forex currency pairs from countries with large amounts of commodity reserves. ... Traders and investors looking to gain exposure to commodity price fluctuations often take positions in commodity currency pairs as a proxy investment to buying commodities. | |

| Forex instruments | |

| CFDs | |

| ETFs | |

| Stocks | |

| Bonds | |

| Cryptocurrencey | |

| Trading Signals | |

| Educational Service | |

| Copy/Social Tradings |

Octa

Min.Deposit: 25 USD

Regulated: FSCA

Max.Leverage: 1:1000

Country: Array

Apply Now View Full Review »

Headway

Min.Deposit: $1

Regulated: FSCA

Max.Leverage: 1:2000

Country: Array

Apply Now View Full Review »ZForex

Min.Deposit: $10

Regulated: MWALI

Max.Leverage: 1:1000

Country: Array

Apply Now View Full Review »

Bryan Says :

Hello, has anyone traded with the Amarkets? Any comments? South America specifically, thanks!