XM

Regulated By : ASIC, CySEC, FCA

Headquarters : ![]() Cyprus

Cyprus

Min Deposit : 5 USD

US Clients :

Leverage : 1:888

Established Year : 2009

Every day, a massive number of people are jumping into the forex trading business. If one has the expertise of interminable trading, then no one can stop his success in the forex industry unless you are trading on the right platform.

As opportunities are ascending, many scams and illegal forex brokers are appearing under the cloak of professionalism.

Hence, to start trading, the utmost requirement is to play your every transaction with a reliable and advanced forex broker. And that is the common mistake typical traders do when they enter the forex market.

So, today, I am going to share my experience through this XM review to learn why this platform is the best forex broker for beginners to start with.

What is XM

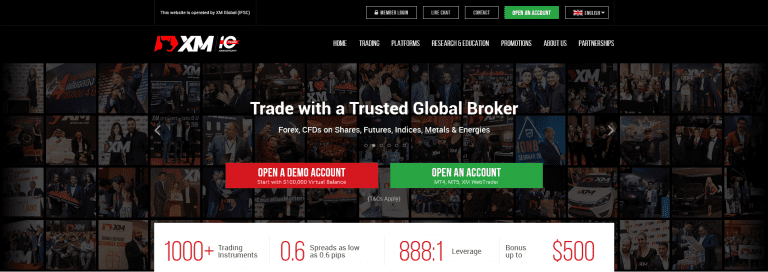

Presently, XM is dominating the industry with its easy-to-grab features and extensive opportunities. As a beginner, you can start learning to trade, link up with trusted traders, buy and sell currencies with safety, all just on one single platform.

It is in operation since 2009 with an established track record. XM is one of few forex trading platforms that is operating under strong regulation.

The Trading Point of Financial Instruments UK Limited currently owned the platform. Its parent company got the license in Cyprus by CySEC, license number 120/10.

In Australia, the license number is 44370, which has been issued by ASIC (Australian Securities and Investment Commission.)

Detailed Review of XM

As a competitive brokerage house, XM is operating right now, with a trust of 2.5 million traders. Let’s continue the walkthrough of XM to learn more about its features and facilities.

At A Glance

XM is rocking on the forex ground with lots of potentialities and awards in the pocket. Like this year, XM won the title of Best FX Service Provider, Global Forex Broker of The Year, Most Trusted Asian Forex Broker, Best FX Broker for Europe 2019, and list must go on.

But maybe you are not interested in that. Instead, you are dying to know how the platform can make your dreams come true. Well, just like my attitude. So, let’s look into the offers and features first.

Trader Account Type

Unlike others, you will get 4 types of account access while trading on the platform – Micro, Standard, XM Ultra Low, and XM Zero account.

- Opening balance of $5 for XM Micro and Standard accounts

- Opening balance $50 for XM Ultra-Low accounts

- XM Zero/Share/ECN type account requires $10 of the initial deposit

Leverage

The leverage of all accounts differs depending on the transactional amount. On XM, minimum leverage ratios start the same for all accounts excluding Share account. There is no leverage.

- 1:1 to 1:188 for $5 to $20,000

- 1:1 to 1:1 to 1:1200 for $20,0001 to $100,000

- 1:1 to 1:100 for more than $100,000 of transactions

Although previously, upon the XM Zero account, the maximum leverage was 500:1. It’s applicable for USD, JPY, or EUR currencies

Floating Spread

Here on XM, the contrast between the bid and asking price is tolerable completive. And, the spreads on all majors are applicable for all types of accounts.

- As low as 1 pip for XM Micro and XM Standard accounts

- As low as 0.6 pips for XM Ultra-Low accounts

- As per the underlying give-and-take for Shares accounts

Commission

Fortunately, there is no hidden commission on any accounts. But the Shares account holders have to consider a little as their transaction comes with a massive risk for the platform.

Order Volume

XM is offering the minimum level of trade volume compared to other brokerage platforms. So, you can bet on low investments. For Micro (MT4), Standard, and Ultra-Low Standard accounts, the minimum order volume is 0.01 lots.

On the contrary, it is 0.1 lots for Standard (MT5), Micro Ultra Low accounts. You can trade a minimum of 1 lot if you are a Shares account holder.

Available Trading Instruments

The best thing about XM is you can choose from over 1000 instruments to start trading. There are 55+ currency pairs, 600+ stock CFDs, commodities, major global equity indices, precious metals like gold and silver, energies, and shares.

Trading Platforms

On XM, you can trade with both MetaTrader 4 and 5 facilities on different platforms like Windows, Mac, iOS, Android, Webtrader, Multiterminal. Let’s look into their exclusive features.

XM MT4 Features

- Facilitates with expert advisors

- Built-in indicators with customization support

- 1 click trading

- Can do a big chunk of orders

- Access to analytics and chart tools

- Data back-up with security

- Mailing system

XM MT5 Features

- Over 1000 instruments support

- Can display 100 charts instantaneously

- 80+ technical indicators

- Built-in MQL5

- Mobile and web trading support

- Currency tester and alerts

- Mailing system

- 40+ analytical access

Why You Should Trade ON XM

It’s not just only one reason that I emphasize XM as one of the favorite platforms. Firstly, you can trade on XM with excellent conditions that are very flexible for a newbie trader. Besides, one can trade with micro-lots. To me, that was the foremost choice when I was a toddler in the industry.

If talking more about the advantages of trading on XM, I would like to hover on its execution flexibility, as the same execution quality applied for all types of accounts. Furthermore, you can get access to regular and simultaneous updates about the industry.

You can monitor and manage your trading from the web, desktop, and even from your mobile. Alongside this, there is support for the traders in multi-language. What more a trader can expect?

Reasons You Should Trade on XM

- Licensed, regulated, and reliable broker

- Operating in more than 196 countries with 30+ languages support

- Beginner-friendly trading platform

- Can starts from as little as you can invest

- Massive range of instruments

- Simultaneous result of multi analytical tools

Final Thought

In the end, the XM review is all about my thoughts and real-life trading experiences. It’s evident that success in trading depending mostly on your proclivity of trading. But a reliable and opportunistic platform always plays an imperative role here, especially for beginners.

That’s why I have tried to simplify all the facts and features of XM in this detailed review. I believe those are enough to bring you towards the right decision. In any case, if you find more queries, hit the comment section. Take care.

XM Overview

Company Information

| Broker Details | Info |

|---|---|

RegulatorsWhat Is Regulation?Forex regulation is therefore all about consumer protection. Regulated Forex brokers are less likely to cheat their clients and where such infractions happen, regulators are empowered by the laws of their respective jurisdictions to apply appropriate sanctions. | ASIC, CySEC, FCA |

| Country | |

Base CurrenciesWhat is Base Currency?In the forex market, currency unit prices are quoted as currency pairs. The base currency – also called the transaction currency - is the first currency appearing in a currency pair quotation, followed by the second part of the quotation, called the quote currency or the counter currency. For accounting purposes, a firm may use the base currency as the domestic currency or accounting currency to represent all profits and losses. | USD, EUR |

Type Of BrokersBroker TypesThere are two types of brokers: regular brokers who deal directly with their clients and broker-resellers who act as intermediaries between the client and a larger broker. Regular brokers generally are held in higher regard than broker-resellers. | ECN, STP |

Trading PlatformWhat is Trading Platform?A currency trading platform is a software interface provided by currency brokers to their customers to give them access as traders in the Forex markets. This may be an online, web-based portal, mobile app, a standalone downloadable program, or any combination of the three. | Desktop, Mobile, MT4, MT5 |

| Established Year | 2009 |

| Website Language | English, Chinese, Spanish |

| US Clients |

Payment Option

| Method | Getway |

|---|---|

| Acc Funding Methods | |

| Acc Withdrawal Methods |

Transaction Fees

| Getway | Fees |

|---|---|

| Skrill | 2.99% + $0.30 per transaction |

| Wire transfer | 1% - 4% of the transaction amount |

| WebMoney | 0.8% - 2.5% of the transaction amount |

| Perfect Money | 0.5% - 1.9% of the transaction amount |

| Visa Card | 1.9% - 2.9% of the transaction amount |

| Master Card | 1.9% - 2.9% of the transaction amount |

Trading Account Options

| Type | Info |

|---|---|

Maximum LeverageForex LeverageLeverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance alone. ... Forex traders often use leverage to profit from relatively small price changes in currency pairs. Leverage, however, can amplify both profits as well as losses. | 1:888 |

Mini AccountWhat Is Mini Account?A forex mini account is a foreign exchange (FX) account which allows beginner traders to enter the currency market using smaller size (mini lot) positions and trading quantities, thus lowering the funds at risk and limiting potential losses. | |

| VIP Accounts | |

Segregated AccountsWhat Is Segregated Account?Segregated account is an important term in the context of Forex trading in which a broker holds their client funds in segregated (separate) accounts that are different from the broker's core banking account. Segregated accounts are used to differentiate between the broker's working capital and its client investments. | |

| Free Demo Accounts | |

Managed AccountsWhat Is Managed Accounts?A managed forex account is where a professional trader/money manager manages the trading on the clients' behalf. The account is made up of a personalized portfolio owned by a single investor. The portfolio and account is handled accordingly to the investors needs. | |

| Pro Account | |

| Minimum Deposit | 5 USD |

Islamic AccountWhat Is Islamic Account?An Islamic Forex account is a halal trading account that is offered to clients who respect the Quran and wish to invest in the Islamic stock market following the principles of Islamic finance. ... As Sharia law prohibits the accumulation of interest, traders with Islamic accounts do not pay or receive interest rates. |

Contact Information & Support

| Type | Info |

|---|---|

| Telephone No | +501 223-6696 |

| support@xm.com | |

| 24 Hours Support | |

| Support During Weekends | |

| Address | No.5 Cork Street, Belize City, Belize, C.A. |

| Website | https://www.xm.com/ |

XM Trading Features

Suitable For

| Trader Level | Yes/No |

|---|---|

| Publicly Traded | |

| Beginners | |

| Day Trading | |

| Weekly Trading | |

| Professionals | |

| Swing Trading |

Spreads And Commission

| Trader Level | Yes/No |

|---|---|

Minimum SpreadsWhat Is Spreads?The forex spread is the difference between a forex broker's sell rate and buy rate when exchanging or trading currencies. Spreads can be narrower or wider, depending on the currency involved, the time of day a trade is initiated, and economic conditions. | 0.1 |

| Commission | |

| Fixed Spreads |

XM Release 6 Bonuses

Trading Services

| Service | Info |

|---|---|

HedgingWhat Is Hedging?Hedging with forex is a strategy used to protect one's position in a currency pair from an adverse move. It is typically a form of short-term protection when a trader is concerned about news or an event triggering volatility in currency markets. There are two related strategies when talking about hedging forex pairs in this way. One is to place a hedge by taking the opposite position in the same currency pair, and the second approach is to buy forex options. | |

| News Trading | |

ScalpingWhat Is Scalping?Scalping in the forex market involves trading currencies based on a set of real-time analysis. The purpose of scalping is to make a profit by buying or selling currencies and holding the position for a very short time and closing it for a small profit. | |

| Automated Trading | |

IndicesWhat Is Indices?The indices track the underlying prices of the currency pairs within that index. If the individual forex prices in that index increase, then the value of the index will go up. Conversely, if the individual FX prices decrease, then the value of that index will fall. | |

CommoditiesWhat Is Commodities?The commodity pairs, or commodity currencies, are those forex currency pairs from countries with large amounts of commodity reserves. ... Traders and investors looking to gain exposure to commodity price fluctuations often take positions in commodity currency pairs as a proxy investment to buying commodities. | |

| Forex instruments | |

| CFDs | |

| ETFs | |

| Stocks | |

| Bonds | |

| Cryptocurrencey | |

| Trading Signals | |

| Educational Service | |

| Copy/Social Tradings |

Octa

Min.Deposit: 25 USD

Regulated: FSCA

Max.Leverage: 1:1000

Country: Array

Apply Now View Full Review »

Headway

Min.Deposit: $1

Regulated: FSCA

Max.Leverage: 1:2000

Country: Array

Apply Now View Full Review »ZForex

Min.Deposit: $10

Regulated: MWALI

Max.Leverage: 1:1000

Country: Array

Apply Now View Full Review »

Sorin Says :

Old broker, good reputation, recommend

Tim Coom Says :

U r right bro

Claudio Says :

The broker exceeded my expectations. I was impressed with the variety of financial instruments. I think it’s a good opportunity to take advantage of trading many assets while there is high volatility around the world because of trade wars all over the world.

Modesto Detti Says :

Okay, I’m sorry but that’s the first thing I noticed: there IS a deposit bonus and I actually got one myself. Maybe have to change the info a little bit