Finteria

Regulated By : FSA

Headquarters : ![]() Saint Vincent and the Grenadines

Saint Vincent and the Grenadines

Min Deposit : $10

US Clients :

Leverage : 1:500

Established Year : 2020

What is Finteria?

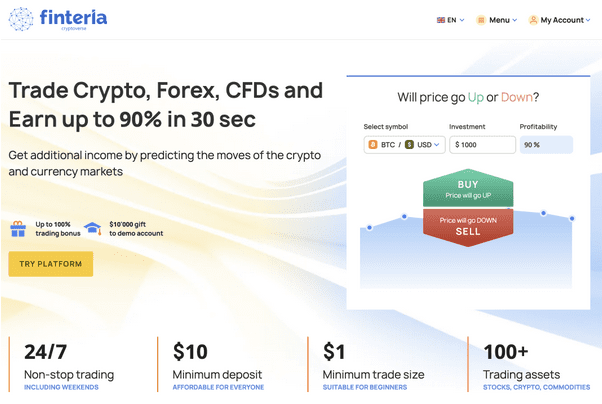

Finteria, established in 2020, is an online trading platform enabling users to engage in diverse asset transactions, including stocks, currencies, commodities, and cryptocurrencies, through contracts for difference (CFDs) and binary options. Based in St. Vincent and the Grenadines, Finteria boasts a worldwide presence, catering to millions of customers from over 200 nations.

Priding itself on delivering a user-centric and adaptable trading experience, Finteria features customizable charts, indicators, and tools, as well as swift and secure transactions, round-the-clock customer assistance, and complimentary educational resources. Furthermore, Finteria offers a mobile app for Android devices, empowering users to trade while on the move.

Discovering the Advantages and Disadvantages of Finteria

Looking to use Finteria for your online trading needs? Like any other platform, Finteria has its fair share of pros and cons.

Pros

- Wide range of assets and markets: Finteria offers over 5000 assets across 7 categories, including stocks, currencies, commodities, cryptocurrencies, and ETFs.

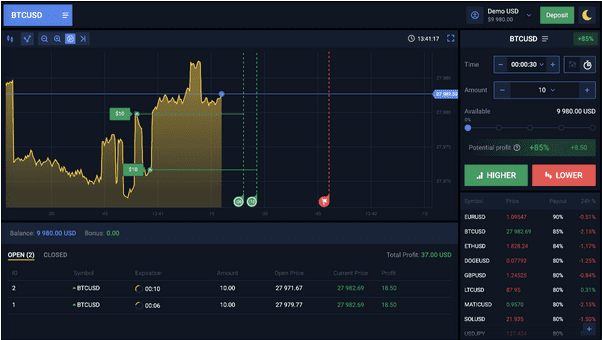

- User-friendly trading platform: Finteria’s platform is designed to be intuitive, customizable, and responsive. You’ll have access to advanced charting tools, technical indicators, and risk management features.

- Low starting costs: With a minimum deposit of just $10 and the ability to place trades with as little as $1, Finteria is an affordable option for beginners and low-risk traders.

- Free demo account and tutorials: Finteria provides a demo account with virtual funds and free educational resources, such as video tutorials, webinars, and e-books, to help you get started and learn how to trade effectively and safely.

Cons

- Limited customer support: Finteria primarily offers customer support through email and live chat, which may not be sufficient for some users who prefer phone or in-person support.

- Restricted access: Finteria is not available to residents of certain countries due to legal or regulatory restrictions.

- High risk of losses: As with any financial market, there is a high risk of losses when trading on Finteria. Despite its risk management tools and educational resources, Finteria does not guarantee profits or prevent losses.

- Overall, Finteria offers a diverse range of assets, a user-friendly platform, and low starting costs, making it an attractive option for those looking to get started in online trading. However, it’s important to keep in mind the limitations of customer support and the risks associated with trading.

Exploring Finteria in Comparison to Other Trading Platforms

If you’re looking for a trading platform and considering Finteria, you might wonder how it stacks up against its competitors. To help you out, we’ve done some research and compared Finteria to other popular platforms based on a few key factors.

First, let’s talk about trading conditions. Finteria offers some great trading conditions, including low minimum deposits and trade sizes, high leverage, and a wide range of assets and markets. That being said, other platforms like eToro and Plus500 offer unique features like sentiment analysis that might be more appealing to some users.

Next up, platform features. Finteria’s platform is known for being one of the most advanced and user-friendly options out there, with plenty of charting and analysis tools at your disposal. However, other platforms like MetaTrader 4 and TradingView offer even more customization options, integration with third-party software, and community-driven content. These features might be more attractive to traders who are looking for a more personalized experience.

Finally, let’s talk about fees and commissions. Finteria’s fees and commissions vary depending on the asset and trade, but they are generally lower than some of its competitors, like Robinhood and Webull. This can be a big plus for traders who want to keep their costs low.

Overall, Finteria is a great choice for many traders, with competitive trading conditions and a user-friendly platform. However, it’s important to consider your own trading style and needs when choosing a platform. By comparing different options based on factors like trading conditions, platform features, and fees, you can find the platform that’s the best fit for you.

How to Sign Up and Trade on Finteria?

Interested in trading with Finteria? Follow these simple steps:

- First, head to the Finteria website and click on the Sign Up button. From there, fill out the necessary personal and financial information, such as your email and password.

- After that, verify your account and identity by submitting the required documents, which may include your ID or passport.

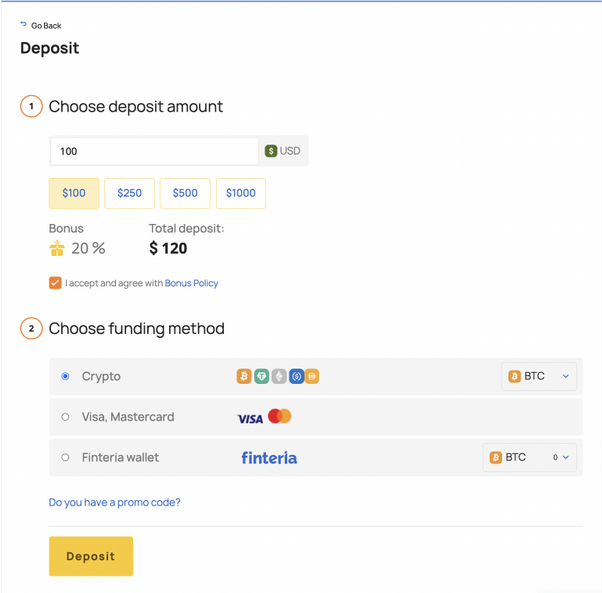

- Next, fund your account using one of the available payment methods, like a credit card or cryptocurrency.

- Once your account is set up and funded, select the market and asset you want to trade and set your trade parameters, including direction, amount, and duration.

- Monitor your trade and feel free to close it at any time if you want to realize a profit or limit a loss.

If you’re new to trading, Finteria offers a demo account option where you can practice and hone your skills without risking real money.

Conclusion – Should You Consider Trying Out Finteria?

To sum it up, is Finteria worth giving a shot? Our analysis and personal experience tell us that Finteria is a trustworthy and innovative online trading platform. It offers a wide range of assets, markets, and features that cater to all levels of traders, whether you are a beginner or an expert.

However, we want to be transparent with you and point out that Finteria is not without its limitations and risks. For instance, the platform has limited support and market volatility, which you should keep in mind. As a result, we suggest that you conduct your own research and manage your risk appropriately, considering your personal goals and preferences before committing to Finteria or any other trading platform.

Overall, we believe that Finteria is a great option for those who are interested in online trading. Just be sure to take the necessary precautions and educate yourself before jumping in.

Learn More About Finteria and the World of Trading

If you’re keen on delving deeper into the world of online trading, investment strategies, and financial markets, Finteria’s Twitter account, YouTube videos, and educational materials might just be what you’re looking for. Here are some examples of the offerings available:

Educational materials

Finteria’s website provides a broad range of educational resources, including articles, that cover different topics related to trading. These include:

Introduction to trading: This section covers the fundamentals of trading, asset types, risk management, and platform features.

Technical analysis: Here, you’ll learn about charting tools, indicators, patterns, and strategies for analyzing price movements.

Fundamental analysis: This section explores economic indicators, news events, and market trends that affect asset prices.

Trading psychology: Discover how emotions, biases, and habits can impact trading decisions and outcomes.

Trading strategies: This section outlines popular and tested trading approaches such as scalping, swing trading, and trend following.

Finteria’s education materials are created to be practical, up-to-date, and accessible to both novice and experienced traders.

Twitter account

Finteria’s Twitter account is an excellent source of the latest news, trends, and insights in the financial world. It also offers an opportunity to engage with other traders and experts. Here are some of the topics Finteria’s Twitter account provides updates on:

Market analysis: Commentary, charts, and forecasts on significant events and assets.

Company news: Announcements, partnerships, and accomplishments of Finteria and its associates.

Trading tips: Advice, strategies, and best practices for successful trading.

Community events: Contests, giveaways, and promotions for Finteria’s followers.

With a growing number of followers and engagement, Finteria’s Twitter account demonstrates its commitment to transparency, communication, and customer satisfaction.

YouTube videos

Finteria’s YouTube channel offers a wealth of video content covering different aspects of trading and investing. It features expert analysis, interviews, and tutorials. Some of the videos available include:

Finteria Overview

Company Information

| Broker Details | Info |

|---|---|

RegulatorsWhat Is Regulation?Forex regulation is therefore all about consumer protection. Regulated Forex brokers are less likely to cheat their clients and where such infractions happen, regulators are empowered by the laws of their respective jurisdictions to apply appropriate sanctions. | FSA |

| Country | |

Base CurrenciesWhat is Base Currency?In the forex market, currency unit prices are quoted as currency pairs. The base currency – also called the transaction currency - is the first currency appearing in a currency pair quotation, followed by the second part of the quotation, called the quote currency or the counter currency. For accounting purposes, a firm may use the base currency as the domestic currency or accounting currency to represent all profits and losses. | USD |

Type Of BrokersBroker TypesThere are two types of brokers: regular brokers who deal directly with their clients and broker-resellers who act as intermediaries between the client and a larger broker. Regular brokers generally are held in higher regard than broker-resellers. | Forex, Binary options |

Trading PlatformWhat is Trading Platform?A currency trading platform is a software interface provided by currency brokers to their customers to give them access as traders in the Forex markets. This may be an online, web-based portal, mobile app, a standalone downloadable program, or any combination of the three. | WebTrader, MT4, MT5 |

| Established Year | 2020 |

| Website Language | English, Turkish, Español, French, Italiano, Português |

| US Clients |

Payment Option

| Method | Getway |

|---|---|

| Acc Funding Methods | |

| Acc Withdrawal Methods |

Transaction Fees

| Getway | Fees |

|---|---|

| Visa Card | 1.9% - 2.9% of the transaction amount |

| Master Card | 1.9% - 2.9% of the transaction amount |

| Tether | Varies depending on the exchange rate |

Trading Account Options

| Type | Info |

|---|---|

Maximum LeverageForex LeverageLeverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance alone. ... Forex traders often use leverage to profit from relatively small price changes in currency pairs. Leverage, however, can amplify both profits as well as losses. | 1:500 |

Mini AccountWhat Is Mini Account?A forex mini account is a foreign exchange (FX) account which allows beginner traders to enter the currency market using smaller size (mini lot) positions and trading quantities, thus lowering the funds at risk and limiting potential losses. | |

| VIP Accounts | |

Segregated AccountsWhat Is Segregated Account?Segregated account is an important term in the context of Forex trading in which a broker holds their client funds in segregated (separate) accounts that are different from the broker's core banking account. Segregated accounts are used to differentiate between the broker's working capital and its client investments. | |

| Free Demo Accounts | |

Managed AccountsWhat Is Managed Accounts?A managed forex account is where a professional trader/money manager manages the trading on the clients' behalf. The account is made up of a personalized portfolio owned by a single investor. The portfolio and account is handled accordingly to the investors needs. | |

| Pro Account | |

| Minimum Deposit | $10 |

Islamic AccountWhat Is Islamic Account?An Islamic Forex account is a halal trading account that is offered to clients who respect the Quran and wish to invest in the Islamic stock market following the principles of Islamic finance. ... As Sharia law prohibits the accumulation of interest, traders with Islamic accounts do not pay or receive interest rates. |

Contact Information & Support

| Type | Info |

|---|---|

| Telephone No | +447458038357 |

| support@finteria.com | |

| 24 Hours Support | |

| Support During Weekends | |

| Address | The Financial Services Center, Stoney Ground, Kingstown |

| Website | https://finteria.com/ |

Finteria Trading Features

Suitable For

| Trader Level | Yes/No |

|---|---|

| Publicly Traded | |

| Beginners | |

| Day Trading | |

| Weekly Trading | |

| Professionals | |

| Swing Trading |

Spreads And Commission

| Trader Level | Yes/No |

|---|---|

Minimum SpreadsWhat Is Spreads?The forex spread is the difference between a forex broker's sell rate and buy rate when exchanging or trading currencies. Spreads can be narrower or wider, depending on the currency involved, the time of day a trade is initiated, and economic conditions. | Fixed |

| Commission | |

| Fixed Spreads |

Trading Services

| Service | Info |

|---|---|

HedgingWhat Is Hedging?Hedging with forex is a strategy used to protect one's position in a currency pair from an adverse move. It is typically a form of short-term protection when a trader is concerned about news or an event triggering volatility in currency markets. There are two related strategies when talking about hedging forex pairs in this way. One is to place a hedge by taking the opposite position in the same currency pair, and the second approach is to buy forex options. | |

| News Trading | |

ScalpingWhat Is Scalping?Scalping in the forex market involves trading currencies based on a set of real-time analysis. The purpose of scalping is to make a profit by buying or selling currencies and holding the position for a very short time and closing it for a small profit. | |

| Automated Trading | |

IndicesWhat Is Indices?The indices track the underlying prices of the currency pairs within that index. If the individual forex prices in that index increase, then the value of the index will go up. Conversely, if the individual FX prices decrease, then the value of that index will fall. | |

CommoditiesWhat Is Commodities?The commodity pairs, or commodity currencies, are those forex currency pairs from countries with large amounts of commodity reserves. ... Traders and investors looking to gain exposure to commodity price fluctuations often take positions in commodity currency pairs as a proxy investment to buying commodities. | |

| Forex instruments | |

| CFDs | |

| ETFs | |

| Stocks | |

| Bonds | |

| Cryptocurrencey | |

| Trading Signals | |

| Educational Service | |

| Copy/Social Tradings |

Octa

Min.Deposit: 25 USD

Regulated: FSCA

Max.Leverage: 1:1000

Country: Array

Apply Now View Full Review »

Headway

Min.Deposit: $1

Regulated: FSCA

Max.Leverage: 1:2000

Country: Array

Apply Now View Full Review »ZForex

Min.Deposit: $10

Regulated: MWALI

Max.Leverage: 1:1000

Country: Array

Apply Now View Full Review »

Put Your Comment