Exness

Regulated By : CySEC, FCA

Headquarters :  Cyprus

Cyprus

Min Deposit : 1 USD

US Clients :

Leverage : 1:200

Established Year : 2008

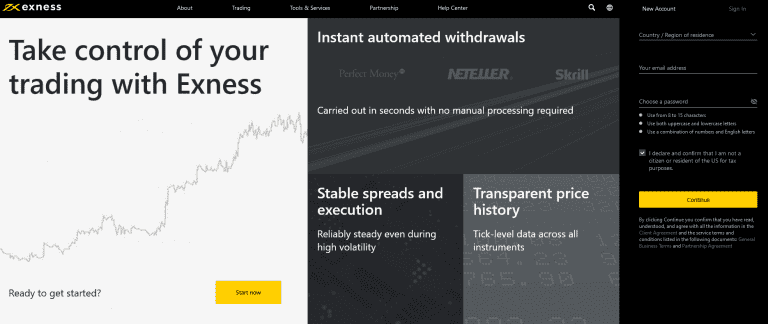

Exness started its journey in the forex era of the twenty century. For sure, it’s been tough to compete with some giant brokers and satisfy their traders with enhanced features.

When it comes to talking about high-quality service, Exness is the industry leader. It’s been more than a decade since the forex broker is operating trades all over the world and achieved positive ratings from thousands of financial journals and agencies.

But is it the number 1 forex broker in 2020? Or, why should you choose Exness to start trading? In today’s Exness review, I am going to answer all of your queries.

What is Exness

Exness is a Forex and CFD brokerage brand, and it operates from Cyprus and the United Kingdom. The brand was initially launched in 2008. It works both the market-making model where it takes the other side of the trade.

And also, an ECN model where it passes those trades over to the electronic communication network, the interbank market, to get you the best possible trade rates.

In terms of regulations, Exness is operated by three subsidiary companies of Exness Group that are based in Cyprus, the UK, and St. Vincent, and the Grenadines.

Detailed Review of Exness

It is one of a few forex brokers that clearly align themselves with success. In this part, we will find out what features the platform is offering and what’s behind its success story.

At A Glance

Undoubtedly, Exness is one of the tough contenders to become the next industry leader. In December 2018, the monthly trading volume on Exness was 348.4 billion USD. And at the same time, the full of zip trader numbers surpassed 50 thousand.

Trader Account Type

The prime account types on Exness are Standard and Professional. Moreover, the Standard account may differ depending on the MetaTrader 5 and 4 holders. Meta Trader has a Standard Cent account type also. You can choose to create a Professional account between Raw Spread, Pro, and Zero.

In anyways, you have to deposits a minimum of $1 for Standard accounts and at least $500 for Professional accounts to start trading on Exness

Leverage

In my thought, the leverage levels on Exness are suitable enough to match your trading flexibilities whether you are new or an expert in the field. The up to 1: Unlimited leverage is giving you the maximum credit trading ability, which is not so common in other platforms.

Under MT5 trading features, you can grab up to 1: 2000 leverage for Standard, Raw Spread, Pro, Zero accounts. For Standard, Cent, Raw Spread, Pro, Zero accounts under MT4, the platform is offering up to 1: Unlimited leverage support.

Spread

Exness caught my attention with their surprising spread from 0.3 pips for Standard accounts. That is 0.00, 0.1, and 0.0 chronologically for Raw Spread, Pro, and Zero account holders.

As the spread is not fixed, there are both risks and opportunities underlying the platform. Well, that is what forex trading is all about. Doesn’t it?

Commission

Unlike typical forex brokers, Exness has a clear subconscious mind to take care of the users and clients, especially beginners. For that reason, there is no charge or commission upon trades that happen by Standard and Cent accounts. Even though for Professional accounts, little commissions pertinent on Exness.

MetaTrader 5

- Up to 3.5 USD per lot for Raw Spread accounts

- No trading commission for Pro accounts

- Up to 3.5 USD for Zero accounts per lot

MetaTrader 4

- Up to 3.5 USD per lot for Raw Spread accounts

- No trading commission for Pro accounts

- Up to 3.5 USD per lot for Zero accounts

Order Volume

You can start trading as a small lot as 0.01 with all trade accounts where the maximum trading limit is up to 7:00 – 20:59 GMT+0: 200 lots, 21:00 – 6:59 GMT+0: 20 lots. The only difference is the Cent account. It’s entitled to transact up to 100 lots for the account owners.

Available Trading Instruments

As I told you before, the platform is for all types of traders. Hence, there are flexibilities to trade crypto also. Moreover, you can trade different currency pairs, metals, energies, indices also. Unfortunately, there is no option to trade stocks on Exness.

Trading Platforms

The modern trader can navigate the financial markets with MetaTrader 5 and 5. For improvement in productivity, both MTs are enhanced with easy interfaces and lots of new trading opportunities.

Nonetheless, you can also choose to trade with the WebTerminal. Let’s take a look at the advantages of all platforms.

Advantages of MetaTrader 5

- With the MetaEditor, you can launch the development environment straight from the terminal

- The MQL 5 enriched with a bunch of numerous graphical objects and functions

- Traders can have manifold positions for a trading instrument with the hedging system

- Simultaneous usability up to 21 timeframes

- Built-in economic calendar

- Access to 22 analytical tools, 38 indicators, and 46 graphical objects

- Supports Windows, Mac, Android, iOS

Advantages of MetaTrader 4

- Instant and Market order execution

- Access to 30 indicators, 23 analytical tools

- AI-based expert advisors

- Protective client data

- Supports Windows, Mac, Android, iOS

Advantages of WebTerminal

- No download requires

- Similar to the desktop versions

- User-friendly, unfailing, and fast enough to complete a decision

- Supports all sorts of trading actions

- Customizable price diagrams

- Access to basic analytical tools

- Get real-time quotations

Why You Should Trade ON Exness

It’s true that the growth pace of Exness is a bit sluggish than the competitors. But the activities of the clients and traders are very resilient. But the prospect is there is tolerably competition scarcity right now. So, it’s better to jump on the platform now rather than when it’s flooded with traders.

Reasons You Should Trade on Exness

- Experienced management board

- Multiple trading instruments

- Suited for beginners and experts

- Reasonable spread points

- 24/7 customer support in 13 languages including Chinese

- Unlimited leverage

- Transparent and reliable forex broker

Final Thought

Clearly, Exness has been around to ensure your funds are safe. I personally, prefer Exness for their maximum leverage besides, the native customer service. As far as my concern, they are trying to maximize the localization, which will be great in the future.

Whatever, it is, in the end, the matter is if you can grab any opportunity or benefit through the platform or not. The Exness review is to clarify the current values that the forex broker is providing and help you reach out to your final decision.

To me, it’s an obvious contender to become the number 1 forex broker in 2020. Let me know yours.

Exness Overview

Company Information

| Broker Details | Info |

|---|---|

RegulatorsWhat Is Regulation?Forex regulation is therefore all about consumer protection. Regulated Forex brokers are less likely to cheat their clients and where such infractions happen, regulators are empowered by the laws of their respective jurisdictions to apply appropriate sanctions. | CySEC, FCA |

| Country |  Cyprus Cyprus |

Base CurrenciesWhat is Base Currency?In the forex market, currency unit prices are quoted as currency pairs. The base currency – also called the transaction currency - is the first currency appearing in a currency pair quotation, followed by the second part of the quotation, called the quote currency or the counter currency. For accounting purposes, a firm may use the base currency as the domestic currency or accounting currency to represent all profits and losses. | USD |

Type Of BrokersBroker TypesThere are two types of brokers: regular brokers who deal directly with their clients and broker-resellers who act as intermediaries between the client and a larger broker. Regular brokers generally are held in higher regard than broker-resellers. | ECN, STP |

Trading PlatformWhat is Trading Platform?A currency trading platform is a software interface provided by currency brokers to their customers to give them access as traders in the Forex markets. This may be an online, web-based portal, mobile app, a standalone downloadable program, or any combination of the three. | Desktop, Mobile, MT4, MT5 |

| Established Year | 2008 |

| Website Language | English |

| US Clients |

Payment Option

| Method | Getway |

|---|---|

| Acc Funding Methods | |

| Acc Withdrawal Methods |

Transaction Fees

| Getway | Fees |

|---|---|

| Skrill | 2.99% + $0.30 per transaction |

| Wire transfer | 1% - 4% of the transaction amount |

| Visa Card | 1.9% - 2.9% of the transaction amount |

| Master Card | 1.9% - 2.9% of the transaction amount |

Trading Account Options

| Type | Info |

|---|---|

Maximum LeverageForex LeverageLeverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance alone. ... Forex traders often use leverage to profit from relatively small price changes in currency pairs. Leverage, however, can amplify both profits as well as losses. | 1:200 |

Mini AccountWhat Is Mini Account?A forex mini account is a foreign exchange (FX) account which allows beginner traders to enter the currency market using smaller size (mini lot) positions and trading quantities, thus lowering the funds at risk and limiting potential losses. | |

| VIP Accounts | |

Segregated AccountsWhat Is Segregated Account?Segregated account is an important term in the context of Forex trading in which a broker holds their client funds in segregated (separate) accounts that are different from the broker's core banking account. Segregated accounts are used to differentiate between the broker's working capital and its client investments. | |

| Free Demo Accounts | |

Managed AccountsWhat Is Managed Accounts?A managed forex account is where a professional trader/money manager manages the trading on the clients' behalf. The account is made up of a personalized portfolio owned by a single investor. The portfolio and account is handled accordingly to the investors needs. | |

| Pro Account | |

| Minimum Deposit | 1 USD |

Islamic AccountWhat Is Islamic Account?An Islamic Forex account is a halal trading account that is offered to clients who respect the Quran and wish to invest in the Islamic stock market following the principles of Islamic finance. ... As Sharia law prohibits the accumulation of interest, traders with Islamic accounts do not pay or receive interest rates. |

Contact Information & Support

| Type | Info |

|---|---|

| Telephone No | +357 25 030 959 |

| support@exness.com | |

| 24 Hours Support | |

| Support During Weekends | |

| Address | Nymstar Limited is at F20, 1st floor, Eden Plaza, Eden Island, Seychelles |

| Website | https://www.exness.com/ |

Exness Trading Features

Suitable For

| Trader Level | Yes/No |

|---|---|

| Publicly Traded | |

| Beginners | |

| Day Trading | |

| Weekly Trading | |

| Professionals | |

| Swing Trading |

Spreads And Commission

| Trader Level | Yes/No |

|---|---|

Minimum SpreadsWhat Is Spreads?The forex spread is the difference between a forex broker's sell rate and buy rate when exchanging or trading currencies. Spreads can be narrower or wider, depending on the currency involved, the time of day a trade is initiated, and economic conditions. | 0.1 |

| Commission | |

| Fixed Spreads |

Exness Release 6 Bonuses

Trading Services

| Service | Info |

|---|---|

HedgingWhat Is Hedging?Hedging with forex is a strategy used to protect one's position in a currency pair from an adverse move. It is typically a form of short-term protection when a trader is concerned about news or an event triggering volatility in currency markets. There are two related strategies when talking about hedging forex pairs in this way. One is to place a hedge by taking the opposite position in the same currency pair, and the second approach is to buy forex options. | |

| News Trading | |

ScalpingWhat Is Scalping?Scalping in the forex market involves trading currencies based on a set of real-time analysis. The purpose of scalping is to make a profit by buying or selling currencies and holding the position for a very short time and closing it for a small profit. | |

| Automated Trading | |

IndicesWhat Is Indices?The indices track the underlying prices of the currency pairs within that index. If the individual forex prices in that index increase, then the value of the index will go up. Conversely, if the individual FX prices decrease, then the value of that index will fall. | |

CommoditiesWhat Is Commodities?The commodity pairs, or commodity currencies, are those forex currency pairs from countries with large amounts of commodity reserves. ... Traders and investors looking to gain exposure to commodity price fluctuations often take positions in commodity currency pairs as a proxy investment to buying commodities. | |

| Forex instruments | |

| CFDs | |

| ETFs | |

| Stocks | |

| Bonds | |

| Cryptocurrencey | |

| Trading Signals | |

| Educational Service | |

| Copy/Social Tradings |

Octa

Min.Deposit: 25 USD

Regulated: FSCA

Max.Leverage: 1:1000

Country: Array

Apply Now View Full Review »

Headway

Min.Deposit: $1

Regulated: FSCA

Max.Leverage: 1:2000

Country: Array

Apply Now View Full Review »

JustMarkets

Min.Deposit: 1 USD

Regulated: FSA

Max.Leverage: 1:3000

Country: Array

Apply Now View Full Review »Exness

Min.Deposit: 1 USD

Regulated: CySEC

Max.Leverage: 1:200

Country: Array

Apply Now View Full Review »RoboForex

Min.Deposit: 1 USD

Regulated: FSC

Max.Leverage: 1:1000

Country: Array

Apply Now View Full Review »

lovely mariam rain Says :

The app offers trading services on all mobile devices, including iPhones, iPads, and PCs. The broker even offers a dedicated mobile trading app for the Apple Watch. they also help solve investment and trading issues at, macwiki@proton. me

yaki Says :

change my life